ICHRA: A new avenue of health insurance innovation

As December came to a close, millions of people across the U.S. updated their health insurance selections for the new year.

Over the past few years, the landscape of what plans are available to them has changed. And much of this evolution is being led by startups. One area where innovation is taking off is that of the health reimbursement arrangement (HRA) plan.

A quick U.S. health insurance primer: Whether you’re one of our many non-American readers or you’re not an insurance wonk, here’s a few details you should know.

- American health insurance is marked by its diversity. There are:

- Public payers for low-income people (Medicaid), seniors and people with disabilities (Medicare), veterans (the Veterans Administration), and indigenous people (the Indian Health Service).

- Private payers accessed via employers or the open healthcare marketplace.

- However, the majority of Americans under 60 get their health coverage through work.

The trouble with employment-based insurance: As we recently discussed, employee health benefits can be a great way for businesses to attract talent, but there are also significant downsides to this model when it’s the main way regular people can afford healthcare coverage.

- For employees: Most healthcare plans can’t travel with you. Employees dependent on their work for healthcare may struggle to maintain health coverage and keep their providers when they change jobs or have to leave the workforce.

- For employers: Offering standard group health insurance plans is a major expense for businesses. That kind of expense can prove prohibitive to smaller companies, further making it harder for them to compete for top talent.

Enter ICHRA: Don’t worry. If you’ve never heard of ICHRA or QSEHRA, you are not alone. Even to many Americans, this type of health coverage is fairly new.

- ICHRA, which stands for Individual Coverage Health Reimbursement Arrangements, came to be through a 2020 Trump Administration policy allowing employers to reimburse employees for qualified medical expenses using tax-free dollars.

- QSEHRA is the version of this kind of health coverage specific to small employers, with IRS-established funding limits.

- ICHRA can work alongside a standard group employee insurance plan—similarly to the tax-advantaged health savings account (HSA) some employers offer.

- The two biggest ICHRA benefits to plan members:

- Increased choice: Even if they also have standard private health insurance, an ICHRA plan gives people more options for where and how they get healthcare.

- Portability: Unlike a traditional employment-based plan, ICHRA can travel with a person as they change jobs, limiting disruption to their care as their life changes.

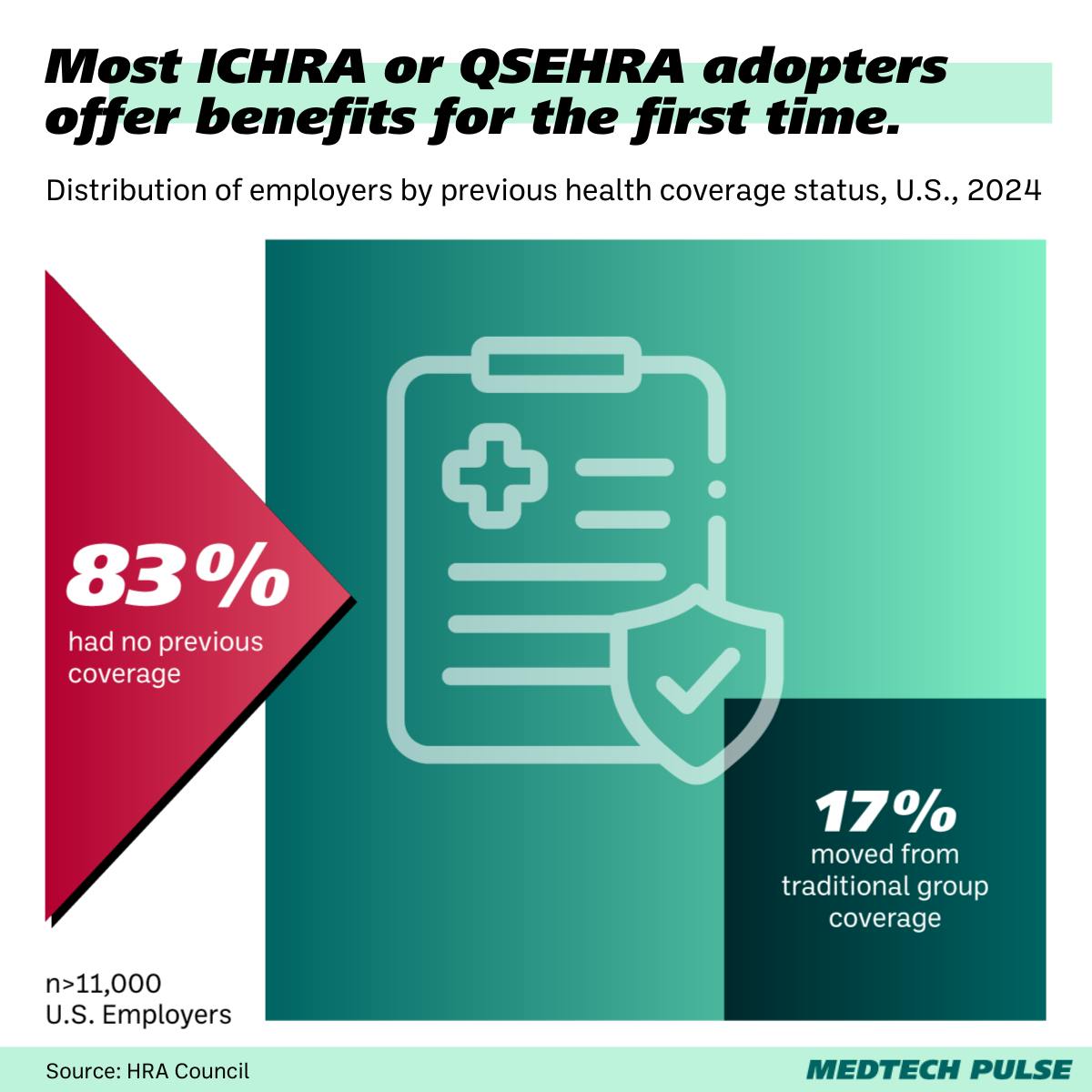

The affordability case appears to be the game-changer for employers. A vast majority of companies offering ICHRA/QSEHRA are first-time employee benefits providers.

The startups leading the ICHRA charge: The world of ICHRA is young, so we’ll need to wait to see if this approach to healthcare coverage stands the test of time.

And as with many frontiers in the healthcare world, healthtech startups are wielding the power of technology to ease the transition and help the products work better for patients and providers. Here are the players we’re watching:

Other innovative approaches to healthcare coverage innovation are direct primary care and condition-specific benefits providers. Whatever the solution may be, we’re heartened by how these innovators are helping us re-imagine what healthcare can look like. Even the most entrenched aspects, like health insurance, can work better for patients everywhere.