Surgical robots’ long journey to the mainstream

The news

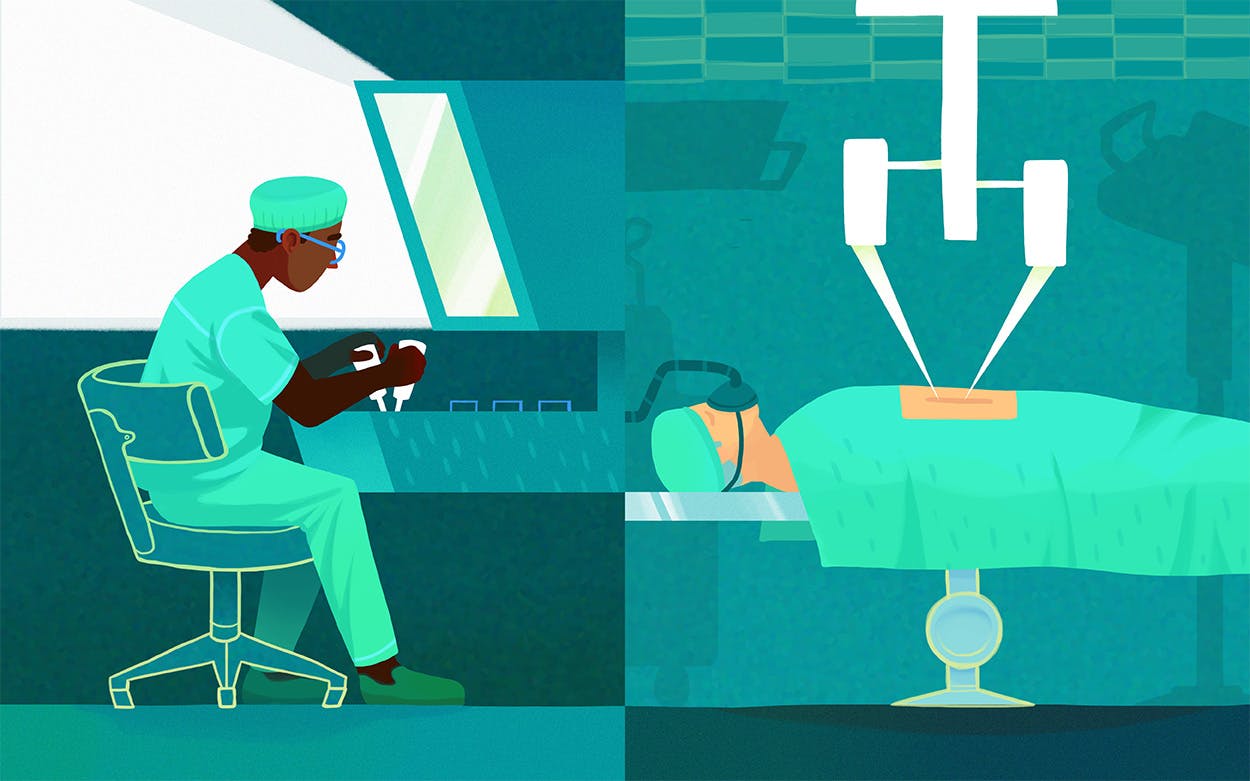

Recently, Medtronic’s robot-assisted surgery system Hugo was used in its first-ever patient procedure: a minimally-invasive prostatectomy performed in Santiago, Chile. This is not radical news, but another step toward robotic surgery becoming mainstream.

The background

The first robot-assisted surgery was performed back in 1985. In the years that followed, a lot of research was done in the field, mainly funded by NASA and DARPA. Another breakthrough milestone took place in 2000, when the da Vinci system obtained FDA approval for general laparoscopic procedures and became the first operative surgical robot in the United States.

All in all, deployment has been very slow in the first 30 years since its inception due to unstable technology and massive investment costs. But in recent years, the market has picked up steam and could be worth $17.8 billion by 2027. In addition to Medtronic, other major medical technology companies such as Stryker, Zimmer Biomet, and Johnson & Johnson are also present in the market.

The bigger picture

For context, the largest market for robotic surgery is the U.S., which accounts for 65% of global sales. According to one study, the number of robot-assisted surgeries in Michigan increased from 1.8% to 15% between 2012 and 2018. However, in the U.S. in particular, there is regular criticism of the technology due to its high cost, inadequate training, and lax regulatory approval.

Our perspective

Most large medical technology companies acquired their respective robotic surgery systems instead of developing them in-house. (e.g., Medtronic: Digital Surgery and Mazor Robotics; Zimmer Biomet: Medtech; J&J: Auris Health; Stryker: Mako Surgical). This innovation strategy is particularly suitable for technologies that lie outside a company's core competencies, but are of great importance to the company’s core business.